Recently, there were changes made to the child tax credit that will benefit many taxpayers. As part of the American Rescue Plan Act that was enacted in March 2021, the child tax credit:

- Amount has increased for certain taxpayers

- Is fully refundable (meaning you can receive it even if you don’t owe the IRS)

- May be partially received in monthly payments

The new law also raised the age of qualifying children to 17 from 16, meaning some families will be able to take advantage of the credit longer.

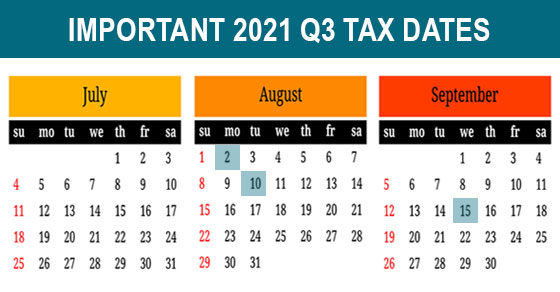

The IRS will pay half the credit in the form of advance monthly payments beginning July 15. Taxpayers will then claim the other half when they file their 2021 income tax return.

Though these tax changes are temporary and only apply to the 2021 tax year, they may present important cashflow and financial planning opportunities today. It is also important to note that the monthly advance of the child tax credit is a significant change. The credit is normally part of your income tax return and would reduce your tax liability. The choice to have the child tax credit advanced will affect your refund or amount due when you file your return. To avoid any surprises, please contact ATA.

Qualifications and how much to expect

The child tax credit and advance payments are based on several factors, including the age of your children and your income.

- The credit for children ages five and younger is up to $3,600 –– with up to $300 received in monthly payments.

- The credit for children ages six to 17 is up to $3,000 –– with up to $250 received in monthly payments.

To qualify for the child tax credit monthly payments, you (and your spouse if you file a joint tax return) must have:

- Filed a 2019 or 2020 tax return and claimed the child tax credit or given the IRS your information using the non-filer tool

- A main home in the U.S. for more than half the year or file a joint return with a spouse who has a main home in the U.S. for more than half the year

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number

- Income less than certain limits

You can take full advantage of the credit if your income (specifically, your modified adjusted gross income) is less than $75,000 for single filers, $150,000 for married filing jointly filers and $112,500 for head of household filers. The credit begins to phase out above those thresholds.

Higher-income families (e.g., married filing jointly couples with $400,000 or less in income or other filers with $200,000 or less in income) will generally get the same credit as prior law (generally $2,000 per qualifying child) but may also choose to receive monthly payments.

Taxpayers generally won’t need to do anything to receive any advance payments as the IRS will use the information it has on file to start issuing the payments.

IRS’s child tax credit update portal

Using the IRS’s child tax credit and update portal, taxpayers can update their information to reflect any new information that might impact their child tax credit amount, such as filing status or number of children. Parents may also use the online portal to elect out of the advance payments or check on the status of payments.

The IRS also has a non-filer portal to use for certain situations.

Let us help you.

With any tax law change, it’s important to revisit your full financial roadmap. We can help you determine how much credit you may be entitled to and whether advance payments are appropriate. How you choose to receive the credit (partially advanced via monthly payments or solely on your next year’s return) could have many impacts to your financial plans.

Please contact one of our offices today to discuss your specific situation. As always, planning ahead can help you maximize your family’s financial situation and position you for greater success.

*Article from AICPA