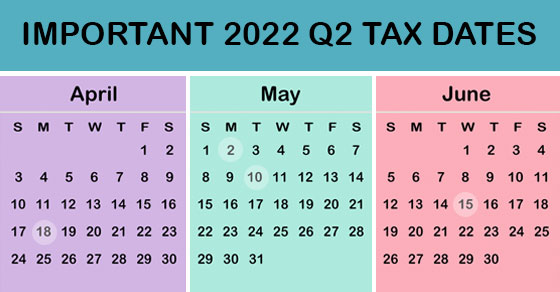

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may not be additional deadlines that apply to you.

The IRS announced tax relief for Tennessee severe storms, straight-line winds and tornadoes that may affect taxpayers’ deadlines. Read below for more information.

Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

April 18

If you’re a calendar-year corporation, file a 2021 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004) and pay any tax due. Corporations pay the first installment of 2022 estimated income taxes.

For individuals, file a 2021 income tax return (Form 1040 or Form 1040-SR) or file for an automatic six-month extension (Form 4868) and paying any tax due. (See June 15 for an exception for certain taxpayers.) For individuals, pay the first installment of 2022 estimated taxes, if you don’t pay income tax through withholding (Form 1040-ES).

May 2

Employers report income tax withholding and FICA taxes for the first quarter of 2022 (Form 941) and pay any tax due.

May 10

Employers report income tax withholding and FICA taxes for the first quarter of 2022 (Form 941), if you deposited on time and fully paid all of the associated taxes due.

June 15

Corporations pay the second installment of 2022 estimated income taxes. The second estimated tax installment for individual taxpayers is due June 15 as well.

Our 2022 tax calendar gives you a quick reference to the most common forms and 2022 tax due dates for individuals, businesses, and tax-exempt organizations. Communicate any questions you may have with your ATA representative. © 2022

However, there is tax relief for Tennessee victims of severe storms, straight-line winds and tornadoes beginning December 10, 2021 now have until May 16, 2022, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following the recent disaster declaration issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in certain areas will receive tax relief.

Individuals and households affected by severe storms, straight-line winds and tornadoes that reside or have a business in Cheatham, Davidson, Decatur, Dickson, Dyer, Gibson, Henderson, Henry, Lake, Obion, Stewart, Sumner, Weakley, and Wilson counties qualify for tax relief. The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. For instance, certain deadlines falling on or after December 10, 2021, and before May 16, 2022, are postponed through May 16, 2022.

Read the full details in this IRS update.